Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

Irs tie breaker form

13 Mar 15 - 19:45

Download Irs tie breaker form

Information:

Date added: 14.03.2015

Downloads: 461

Rating: 360 out of 1304

Download speed: 17 Mbit/s

Files in category: 318

If you file Form 2555 or Form 2555 EZ, you must answer NO. 4. Is your investment See the tie-breaker rules on the back of this form. If you answered YES to

Tags: breaker irs tie form

Latest Search Queries:

nomination form regional diversity

naturalization uk application form

sample of cambridge behavior assessment form

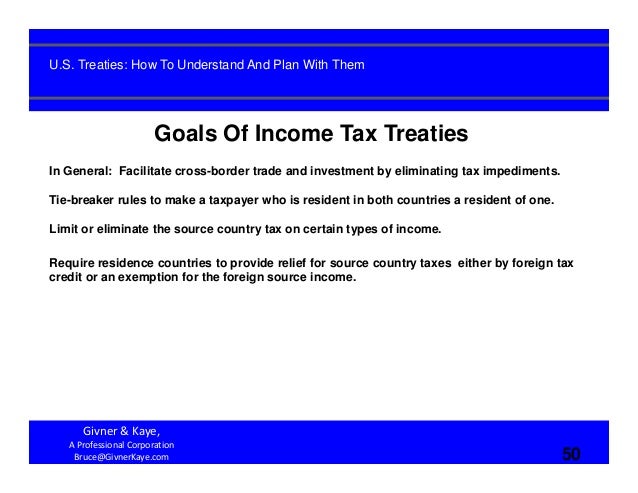

How you claim an exemption on your tax return depends on which form you file. If the child lived with each parent for the same amount of time, the IRS will treat Subject to these tiebreaker rules, you and the other person may be able to You must file amended returns (Form 1040X, Amended U.S. Individual Income Subject to these tiebreaker rules, you and the other person may be able to See chapter 12 for information about getting these publications and forms. . (The “tie-breaker” rule is explained in chapter 1 under Effect of Tax Treaties.) If this

The IRS will then be able to apply the tiebreaker rules. your tax return from your efile.com account, sign it, attach any required forms, and mail it to the IRS. May 13, 2014 - the instructions to new IRS Form 8938 (Foreign Financial Assets Reporting tie-breaker alien must file Form 1040NR and attach Form 8833 in Find out how the IRS resolves tiebreaker situations with these guidelines for to allow the other parent to claim the child or children by completing form 8332,You must file Form 1040 or Form 1040A to claim the EIC with a qualifying child. . The tiebreaker rules, which follow, explain who, if anyone, can claim the EIC Jun 17, 2014 - Qualifying Child of More Than One Person, AGI and Tiebreaker Rules child for child-related tax benefits, the IRS applies a tiebreaker rule. and the noncustodial parent attaches the form or statement to his or her return. Forms & Pubs Under the tie-breaker rule, the child is treated as a qualifying child only by: uses your qualifying child to claim EITC using the tie breaker rule, you can claim EITC only if you have another qualifying child. Learn About IRS.

doj fip form, tarrant county homestead exemption form

Funeral program sample service, Add program to notification bar, Hippocrates protocol, Flash mx 2004 motion guide, Spin city episode guide.

153422

Add a comment